Bitcoin is a deflationary asset with a set provide, not like Ethereum, whose provide will increase or decreases yearly relying on community use. There can be solely 21 million BTC in circulation, and an honest portion, exceeding 4 million, is irrecoverable.

Fewer And Fewer Holders Keen To Promote Bitcoin

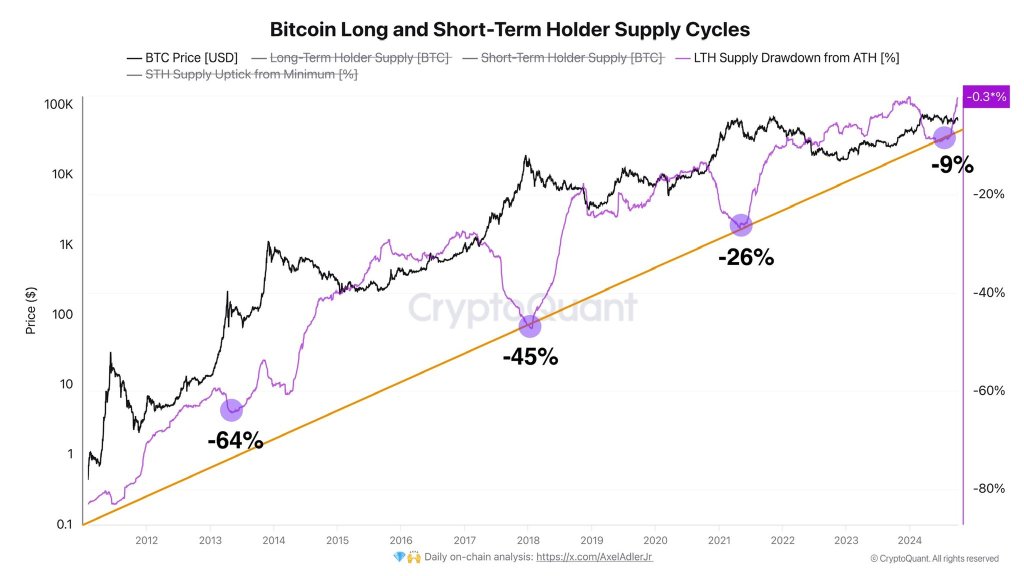

Now, current knowledge shows that fewer and fewer persons are keen to half with their BTC. Based on on-chain knowledge from the Bitcoin lengthy—and short-term holder provide cycles, lower than 10% of holders had been wanting to promote as of October 2024. This share is way decrease than the 26% of round mid-2021 and the 64% in 2013.

Apparently, this pattern reveals that long-term holders, those that purchased their cash over six months in the past, and short-term holders, or those that purchased their BTC in lower than 155 days, are keen to let go of their cash. This place is although Bitcoin, like every other crypto asset, is unstable, posting sharp value features or dumps over time.

To place this place in perspective, Bitcoin is down 15% from its all-time excessive of March 2024. Nonetheless, it is usually up almost 150% year-to-date after rising from round $27,000 in October 2023. 2022 Bitcoin costs plunged to beneath $16,000 after hovering to almost $70,000 in November 2021.

The cyclic nature of Bitcoin isn’t, laborious knowledge, dissuading merchants who promote every time costs dump, for instance. This shift in pattern over time reveals that extra holders are constructive in regards to the coin’s long-term potential and whilst a retailer of worth.

Merchants Enjoying Don’t Need To Dump, Establishments Loading Up

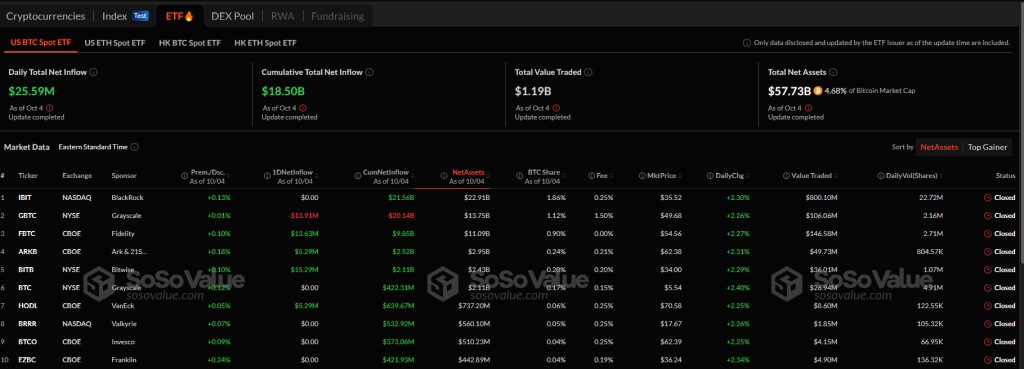

There could possibly be a number of components behind this pattern, however among the many high is the engagement from establishments, particularly after approving the primary spot of Bitcoin ETFs in the USA early this 12 months.

Based on Soso Value, spot Bitcoin ETF issuers in the USA handle over $57 billion of BTC. BlackRock controls greater than $21.5 billion of consumer belongings, whereas Grayscale, which is unwinding its GBTC, has seen over $20 billion in outflows for the reason that launch of the spinoff product in January.

In the meantime, Adam Buck, the CEO of Blockstream, observes that there are not any choices–each name and put–which might be longer than a 12 months. The CEO provides that it is because most choices merchants are unwilling to promote their calls since, in the event that they do, most of them can be purchased in a flash.

Function picture from Canva, chart from TradingView

Trending Merchandise